Why is customs clearance of goods so important?

Passing customs a priori cannot be simple. This is a complicated process that requires a competent approach by both logisticians and lawyers. The latter is mandatory, since the study of the legal framework of different countries and the correct filling of important documents is the main principle of customs clearance of goods.

It is important to know that in case of any, even the slightest violations, customs can apply penalties. They range from administrative fines to seizure of goods. Therefore, if you want your cargo to pass customs quickly and easily, we recommend ordering the "customs clearance of goods" service from our company.

Common mistakes during customs clearance of the goods

First of all, it is worth noting such points as:

- Incorrect calculation of the value indicated in the declaration;

- Incorrect definition of the country of import/origin;

- Late payment of customs duties;

- Lack of documents that must be available during customs clearance, etc.

The customs clearance of goods includes

- Customs clearance (including operational);

- Accreditation at customs;

- Forwarding;

- Assistance with product certification;

- Creation of optimal customs schemes;

- Contract drafting and translation into different languages etc.

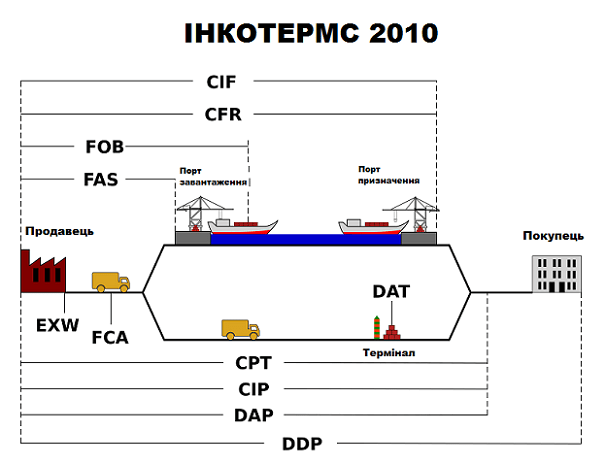

Incoterms 2010 (effective since 01.01.2011) is a set of international rules used in the global trade and recognized worldwide by government agencies, law firms, and merchants.

The scope of Incoterms 2010 covers the rights and obligations of the parties under the contract of sale in terms of the goods delivery.

What is the difference between Incoterms 2010 and the previous one, Incoterms 2000?

Incoterms 2010 provided for two new regulations, DAT and DAP, which can be used as multimodal. At the same time, 4 terms that were least used in practice were abolished, i.e. DAF, DES, DEQ and DDU.

*DAP – delivered at place, DAT – delivered at terminal.

• DAT replaces the term DEQ: the goods are provided to the buyer in unloaded form from the arriving vehicle.

• DAP replaces three terms – DAF, DES and DDU. It means that the seller has fulfilled his obligations when he has provided the buyer with the goods that are ready for unloading at the designated place.

Costs and risks on FOB, CFR and CIF delivery terms are redefined.

*FOB (free on board), CFR (cost and freight) and CIF (cost, insurance and freight).

According to the new Incoterms 2010, the transfer of risks is established after full shipment of cargo on board of the vessel.

Structure of Incoterms 2010 terms. Definition of abbreviations E, F, C, D

• Е – means that the seller has minimal obligations, limited to providing the goods at the disposal of the buyer;

• F – means that obligations are limited to sending the goods to the buyer when the main part of the delivery is not paid;

• С – means that the payment of the main part of the transportation shall be made in full. Responsibilities shall be transferred when the cargo arrives at the terminal;

• D – means the maximum scope of costs and risks vested on the seller. Obligations shall be transferred when the buyer has received the goods.

It is worth noting that the main obligations within the groups are somewhat different. For example, in group C (CIF and CIP) the seller must additionally insure the goods. In group D (DDP), he must pay import duties, and in groups F and D the differences are related to loading/unloading.

Incoterms 2010

Category E

Shipment

|

EXW |

any |

EX Works (... named place). |

Category F

The main transportation is not paid by the seller

|

FCA |

any vehicle |

Free Carrier (...named place) Transfer of |

|

FAS |

sea and |

Free Alongside Ship (... named port of shipment) |

|

FOB |

sea and |

Free On Board (... named port of shipment) Transfer of risks: From the moment of full loading on board of the vessel Export customs formalities: Seller's responsibility |

Category C

The main transportation is paid by the seller

|

CFR |

sea and |

Cost and Freight (... named port of destination) Transfer of risks: From the moment of full loading on board of the vessel Export customs formalities: Seller's responsibility |

|

CIF |

sea and |

Cost, Insurance and Freight (...named port of destination) Transfer of risks: From the moment of full loading on board of the vessel Export customs formalities: Seller's responsibility |

|

CIP |

all vehicles |

Carriage and Insurance Paid To (... named place of destination) Transfer of risks: At the time of delivery/transfer to the carrier Export customs formalities: Seller's responsibility |

|

CPT |

all vehicles |

Carriage Paid To (...named place of destination) Transfer of risks: At the time of delivery/transfer to the carrier Export customs formalities: Seller's responsibility |

Category D

Delivery

|

DAT |

all vehicles |

new! |

|

DAP |

all vehicles |

new! Delivered At Piont (...named point of destination) Transfer of risks: At the time of delivery of the goods to the point specified by the buyer Export customs formalities: Seller's responsibility Import customs formalities: Buyer's responsibility |

|

DDP |

all vehicles |

Delivered Duty Paid (...named place of destination ) Transfer of risks: At the moment the goods are placed at the disposal of the buyer Export customs formalities: Seller’s responsibility Import customs formalities: Seller’s responsibility |

|

DDU |

all vehicles |

Excluded from Incoterms 2010 Delivered Duty Unpaid (... named place of destination) |

|

DAF |

all vehicles |

Excluded from Incoterms 2010 Delivered At Frontier (... named place) |

|

DEQ |

sea and inland waterway transportation |

Excluded from Incoterms 2010 Delivered Ex Quay (...named port of destination) |

|

DES |

sea and inland waterway transportation |

Excluded from Incoterms 2010 Delivered Ex Ship (... named port of destination) |

WHAT UKRAINIAN ENTREPRENEURS NEED TO KNOW ABOUT INCOTERMS 2010

When does Incoterms 2010 become effective?

Incoterms 2010 (International Commercial Terms) was published by the International Chamber of Commerce and has been widely used in international trade since January 1, 2011 along with the previous collections of rules, including the most popular Incoterms 1990 and Inco. Ukraine has a special situation with the entry of the updated version of the International Rules for the Interpretation of Commercial Terms into force.

Incoterms in Ukraine are certain rules prescribed by law, which will become mandatory in our country (for state regulatory and control authorities) 10 days after their publication in Uriadovyi Kurier. As of today, according to the Decree of the President of Ukraine on the Application of International Rules of Interpretation of Commercial Terms dated 04.10.94 N 567/94, the version of 2000 is mandatory. Application of the new Incoterms 2010 is not yet determined by applicable laws and they have not been translated into Ukrainian yet.

How to apply Incoterms 2010 during the customs clearance of goods

New delivery terms (DAT and DAP) in Incoterms 2010 have already been included in the Classifier of Delivery Terms used during the declaration of goods (Order of the State Customs Service of Ukraine dated 31.12.2010 N 1572). At the same time, the State Customs Service of Ukraine warns that the "Terms of delivery under DAT and DAP codes before the official publication of Incoterms 2010 cannot be used when concluding foreign economic agreements (contracts) under the law of Ukraine...". This means that the use of Incoterms 2010 depends on the law applicable to the contract.

Rules for determining the law applicable to a foreign trade agreement

Article 6 of the Law on Foreign Economic Activity states that either the law chosen by the two parties to the contract or the law of the seller's country should be applied.

It is worth noting that if the foreign economic agreement was withdrawn from the legal field of Ukraine, it is possible to rely on Incoterms 2010 and indicate new delivery codes in the customs declaration.

Should you worry about Incoterms 2010

It all depends on the conditions prescribed in your contract. If you refer to previous versions of Incoterms or do not use these rules at all, you can ignore the changes that come into force.

In case you do refer to Incoterms, please, note that since 01.01.2011 any reference to Incoterms in the contract signed on or after January 1 will mean a reference to Incoterms 2010 (unless, of course, the parties agree otherwise). So in this case it is required to think what amendments to make to comply with Incoterms 2010.

Thus, it is required to:

- check the existing contracts;

- made amendments, taking into account Incoterms 2010;

- make the required edits to the standard contract that will be used in the future.

The key amendments you need to know about

1. Four terms, DAF, DES, DEQ and DDU, disappeared and two new terms of delivery, DAP and DAT, were introduced.

2. Two classes of Incoterms were created:

- rules for any type of vehicles;

- rules for sea and river transportation (Incoterms 2000 had four classes).

3. The rules now apply to both international and domestic deliveries.

4. A reference to the use of electronic records has been introduced.

5. Insurance coverage has been revised taking into account amendments made to the Institute Cargo Paragraphs (Institute of London Insurers).

6. Clearly distributed costs at the terminal.

Why amending Incoterms 2010?

The decision to reduce the number of conditions was due to the fact that traders often chose incorrect or confusing conditions that lead to contradictory contracts. The new conditions do not depend on the chosen transport. When determining the customs value of goods delivered in accordance with the new terms, it should be taken into account that under the DAT terms, the cost of goods includes the cost of transportation to the terminal agreed by the parties and unloading at such terminal (excluding the insurance costs).

Under DAP, the invoice value includes only the cost of transportation to the place specified by the parties without unloading and insurance. The determination of the customs value of imported goods is facilitated by the fact that the new rules introduce the obligation of both parties to provide all required information upon request in cases of customs import-export clearance. The previous version of Incoterms did not oblige to such type of cooperation.

Source: "Customs Consultation"

Import is a customs regime under which goods are imported into the territory of Ukraine for domestic use. According to it, goods can stay in the country without temporal and customs restrictions.

Import operations are regulated by:

- national legislation;

- political and legal restriction;

- customs tariff;

- licensing system;

- other non-tariff measures of foreign economic regulation.

When importing goods, it is required to:

- provide the customs with documents certifying the grounds and conditions for the importation of goods;

- pay taxes and duties that are levied on goods when imported into Ukraine;

- comply with the requirements stipulated by law regarding non-tariff regulation measures and other restrictions.

To clear goods and vehicles for import, the following documents are required:

- Payment order for customs payments

settlement account No. 37349210000026, UDK in Kyiv MFO 820019

Consignee – Kyiv Regional Customs. EDRPOU 00137331 Purpose

of payment – Customs payments according to the tariffs. Excluding VAT. - Payment order confirming payment for customs terminal services.

- Contract, specification, additional agreement.

- Original invoice.

- Certificate of origin (CT-1, if produced in the CIS countries, form A, etc.).

- Accreditation card at the customs.

- Certificate of declaration of currency values.

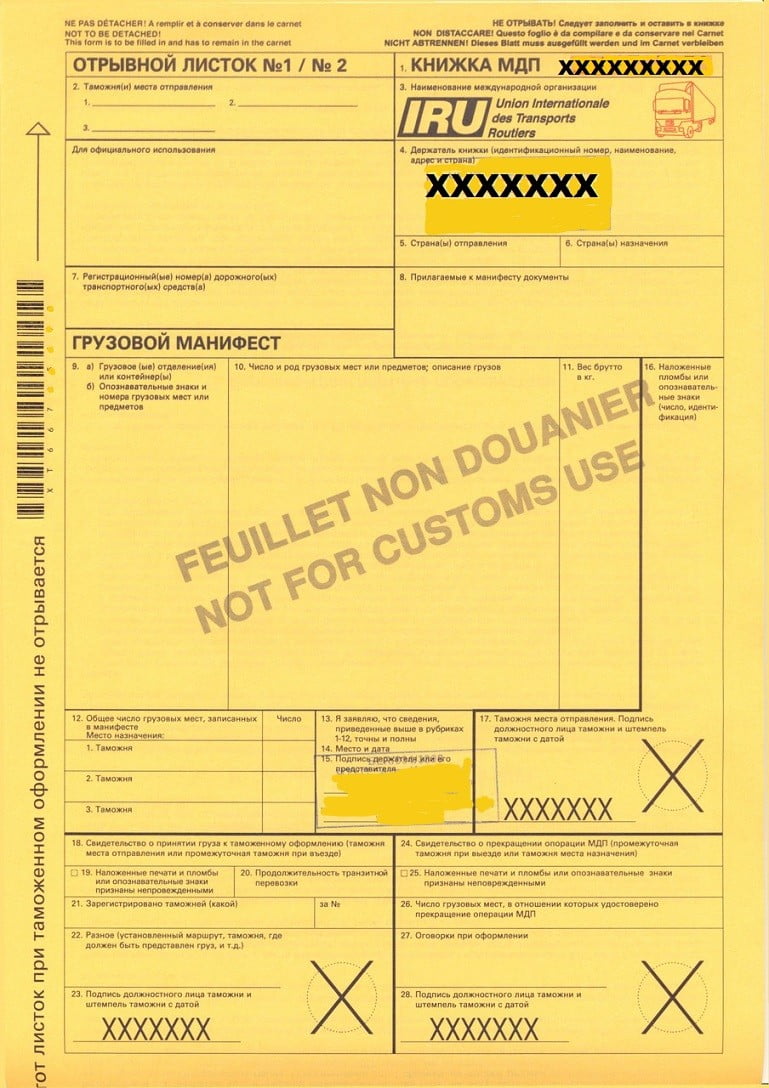

- TIR Carnet.

- CMR waybill (AWB, rail waybill, bill of lading).

- Export declaration of the country of departure.

- If required – permits: quality certificate, sanitary-epidemiological conclusion, registration of the Ministry of Health, State Standard, etc.

- Documents confirming the cost and code of goods (price lists, catalogs, technical description, preliminary conclusions on the cost and code of goods, etc.)

- Payment order for quarantine inspection certified by the City State Quarantine.

- If brokerage organizations will be involved in customs clearance, a contract for the declaration of goods is required.

- A contract for the disposal of containers and packaging with a company having a relevant license and a payment order for prepayment.

Export is a concept used in international trade when selling goods/services to another country. That is, it is a customs regime under which the goods are exported outside the customs territory. Exported goods are registered without the obligation of return.

If goods are subject to export, they must be exported outside the customs territory in the same condition as they were on the day of acceptance of the customs declaration, except for changes in the condition of goods due to natural wear and tear or loss under normal conditions of transportation and storage.

According to the tax legislation, goods during export shall be exempt from taxes, except for export duties and excise duties, or the paid amounts of taxes are subject to refund. When exporting goods outside Ukraine, the customs authority shall be provided with the relevant documents certifying the grounds and conditions of export, payment of taxes and duties imposed on the export of goods, as well as compliance with the requirements of the law.

Documents for clearance of goods and vehicles during the export:

- Payment order for customs payments

settlement account No. 37349210000026, UDC in Kyiv MFO 820019

Consignee – Kyiv Regional Customs. EDRPOU 00137331 Purpose of

payment – Customs payments according to the tariffs. Excluding

VAT (when the inspector executes documents outside the customs control zone or when clearing goods subject to export duty); - Payment order confirming payment for the customs terminal services;

- Required permits (quality certificates, phytosanitary, environmental certificate, expert opinion of a gemologist, etc;)

- Contract, specification, additional agreement;

- Original invoice;

- Certificate of origin (CT-1, if made in Ukraine);

- Accreditation (registration) card in the customs authority;

- Information on the declaration of currency valuables;

- TIR Carnet;

- CMR waybill (AWB, rail waybill, bill of lading);

- Driver's passport;

- Certificate of the right to engage in international transportation under customs control;

- Technical datasheet of the vehicle;

- If brokerage organizations are involved in customs clearance, a contract for the declaration of goods is required.

List of documents required for the export (Ukraine)

During the clearance of goods for export, the following documents shall be presented at the customs:

- Account card of the enterprise;

- Transport documents depending on the type of transportation (railway waybill, air waybill, road waybill or CMR, bill of lading);

- Commercial documents – invoice, proforma, rechnung or other;

- Packing list;

- Foreign economic contract and schedules thereto;

- If available – intermediary agreements;

- Certificate of declaration of currency valuables for the current quarter;

- Specifications for the goods (descriptions, drawings, diagrams, etc. depending on the type of goods);

- Depending on the product code, separate documents of regulatory authorities (licenses, permits, conclusions, etc.);

- Certificate of origin;

- Quality certificates;

- Certificates of conformity;

- Contract for the purchase of goods (or costing for the manufacturer);

- Tax invoices;

- Consignment notes.

List of documents for export of metal products:

- Account card of the enterprise;

- Transport documents depending on the type of transportation (waybill or CMR, bill of lading);

- Commercial documents – invoice, proforma, rechnung or other;

- Packing list;

- Foreign economic contract and schedules thereto;

- If available – intermediary agreements;

- Certificate of declaration of currency valuables for the current quarter;

- Specifications for the goods (descriptions, drawings, diagrams, etc. depending on the type of goods);

- Depending on the product code, separate documents of regulatory authorities (licenses, permits, conclusions, etc.);

- Certificate of origin;

- Quality certificates;

- Certificates of conformity;

- Contract of purchase of goods (or costing for the manufacturer);

- Tax invoices;

- Consignment notes.

An exemplary list of documents for the export of timber by road:

- Accreditation card of the company in customs;

- Certificate of absence of currency valuables there;

- Foreign economic contract;

- Terms of goods delivery – DAF, CIP, EXW, etc;

- Amount and currency of the contract;

- Payment terms – prepayment or deferred payment;

- Payment procedure – transfer to the bank account, letter of credit, etc;

- Payment currency – USD, EURO, RUB, etc;

- References to annexes (specifications), if the contract is concluded for a larger amount than the amount of a specific consignment;

- Goods delivery deadlines;

- TIR CARNET (for exports to Western Europe, Russia, the Baltic States) customs license is the unified transit document reducing the risk of incorrect paperwork and its submission to the customs authorities.

Standard list of documents for IMPORTED cargo clearance in the port:

- original transport document (3 original bills of lading) with the consignee's stamp on the reverse side;

- original invoice with the transfer;

- a letter of order (if the consignee in the bill of lading is "TO ORDER");

- power of attorney for the forwarding in the established form;

- original certificate;

- a copy of the foreign economic agreement;

- a copy of the PN (prior notification).

Additionally:

- For cargoes of animal origin – the original veterinary certificate.

- For cargoes of plant origin – the original phytosanitary certificate.

Depending on the type of cargo, additional documents for container transportation may be required.

Standard list of documents for exported cargo clearance in the port:

- original export declaration for the cargo;

- original transport document – CMR;

- original invoice;

- power of attorney for the forwarding in the established form;

- original certificate;

- a copy of the foreign economic agreement.

Additionally:

- For cargoes of animal origin – the original veterinary certificate.

- For cargoes of plant origin – the original phytosanitary certificate.

You may also need additional documents for registration; it all depends on the type of cargo.

- 3 original bills of lading signed and stamped by the consignee on the reverse side;

- consignor's order (if the bill of lading is "TO ORDER");

- refusal of the first consignee (if the consignee under the bill of lading changes);

- confirmation of the new consignee's readiness to accept the cargo;

- invoice with translation into Russian;

- a power of attorney from the consignee to conduct a feasibility study of the cargo, indicating the name of the cargo in Russian, the HS code, and the exact place of the cargo delivery;

- packing list with translation into Russian;

- certificate of origin;

- quality certificate;

- health certificate (for food products), indicating the date of manufacture and shelf life;

- phytosanitary certificate (for products of plant origin);

- veterinary certificate (for products of animal origin);

- a letter of guarantee for customs clearance within 2 days and to cover the costs of the vehicle downtime.

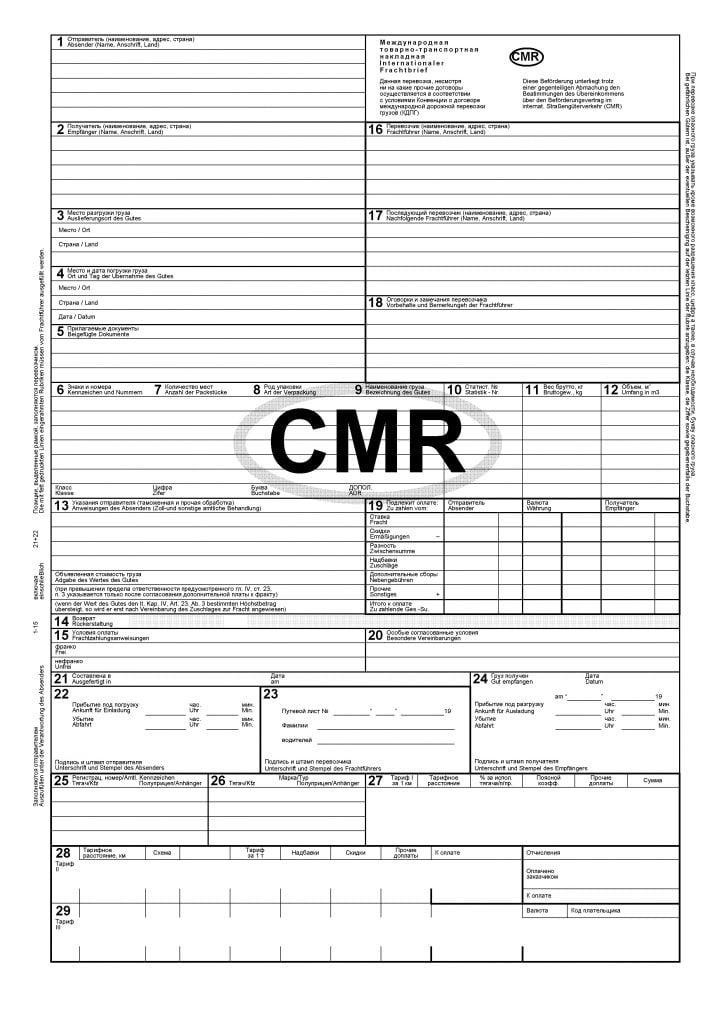

International consignment note CMR

CMR accompanies the contract for the international carriage of goods by road. To use the consignment note, it is sufficient that at least one of the countries between which the delivery is carried out has adopted the Convention on the Contract for the International Carriage of Goods by Road (CMR).

Filling procedure:

Column 1. Indicate the consignor company, its full address, country, city, zip code, street, and house number. If the goods are sent to Russia on behalf of the contract holder by a third company, the name of this company shall be indicated and a note shall be made: "on behalf of". For example, "company B" (consignor) on behalf of "company A" (contract holder).

Column 2. The name of the consignee company, its full address, country, city, zip code, street, and house number shall be indicated.

Column 3. Address of the place of final unloading of the goods (warehouse of the consignee company).

Column 4. Address of the place of loading of goods and date of loading.

Column 5. The numbers of invoices (invoices, proforma invoices), TIR carnet number, if there are numbers of certificates (veterinary, phytosanitary, conformity, etc.).

Columns 6, 7, 8, 9, 10, 11, 12. The number of places, type of packaging, product names, HS codes, gross weight shall be indicated.

Column 13. An important column. The consignee's customs authority (customs office, customs post and customs post code), temporary storage warehouse or customs warehouse, its address and license number (preferably indicating the expiration date of the license) shall be indicated.

Column 15. The terms of delivery according to Incoterms 2010 shall be indicated.

Column 21. Date of completing the CMR.

Columns 16, 17. The name of the carrier, its address shall be indicated. In this column the carrier puts his stamp.

Column 20. For the consignee's notes. Date of the cargo receipt and printing date.

Columns 25, 26. License plate numbers of the tractor and trailer.

Comment to fill in:

Paragraph 1 indicates the details of the consignor (name, address, country). In addition to these data, the carrier shall specify the phone number and surname of the contact person of the consignor in the case any questions arise during transportation (at the customs or at the consignee). Paragraph 2 contains the details of the consignee (name, address, country). It is also required to have the consignee's phone number to resolve issues at the customs upon entry into the country, to find the consignee's office in case of poor command of the consignee's national language. Paragraph 3 indicates the address of the unloading place. If the address of the unloading place is the same as the consignee’s address, the carrier should not have any special questions. However, as a rule, 50% of consignors specify different unloading place and consignee’s address. This is because the cargo is delivered directly to a branch, warehouse, or store. In this case, the carrier must have the phone number of the place of unloading, and if the consignee and the place of unloading are in different cities, then the carrier must call the cargo consignor to clarify the route and find out whether he should arrived at the consignee’s address first or go directly to the address of the unloading place. Paragraph 4 indicates the place and date of the cargo loading. Paragraph 5 contains a list of documents to be attached.

These include:

- Invoice;

- Shipping specification;

- Quality certificate if the goods are of industrial origin;

- Veterinary certificate if the goods are of animal origin;

- Quarantine certificate if the goods are of plant origin;

- Certificate of origin;

- Loading certificate;

- These documents are described in paragraphs 2-8.

In paragraph 6, signs and numbers indicating the class and subclass of hazardous goods transported, determined according to the ADR Convention, shall be specified. Features of the carriage of hazardous goods are described in paragraph 2.

Paragraph 7 contains the number of cargo places. As a rule, up to 90% of all goods transported by road are placed on pallets and it the carrier prefers indicating the number of pallets in paragraph 7. This number can be checked easily by determining the number of rows of pallets and multiplying them by two (there are two pallets per row in the cargo compartment).

Paragraph 8 indicates the type of cargo packaging (cardboard boxes, wooden boxes, metal or plastic barrels, canvas or polyethylene bags, etc.)

Paragraph 9 indicates the name of the cargo.

Paragraph 10 indicates the cargo code by classification.

Paragraph 11 indicates the gross weight in kilograms, that is, the weight of the cargo with packaging, and paragraph 12 – the volume of the cargo in cubic meters.

Paragraph 13 – consignor’s instructions (customs and other processing). This paragraph contains the details of the contract of sale of the goods (number and date of the contract) and, if a license or permit for the export of goods is required, the details of these documents shall be indicated. The box of paragraph 13 shows an envelope. What does it mean? The fact is that one copy of the contract of sale of the goods, as well as a license or permit for the export of goods from the country must be provided at the customs office where the customs clearance of the goods will take place.

The image of the envelope should remind the shipper and the carrier that these documents must be at the customs, and if they are not sent for some reason, the shipper will transfer them in an envelope with the carrier. At the bottom of paragraph 13 the declared value of the cargo shall be indicated. Article 23 (paragraph 3) of the CMR Convention establishes a limit of the carrier's liability restricting the amount of compensation to $12 per kilogram of gross weight shortage (8.33×1.46 = $12.16). However, paragraph 6 of Article 23 provides that a more significant amount of compensation may be claimed from the carrier if the value of the goods has been declared in accordance with Articles 24 and 26.

In the case of declaration of the value of the cargo exceeding the limit specified in paragraph 3 of Article 23, the declared value replaces this limit. The Convention stipulates that upon declaration of the value of the cargo exceeding the liability limit, the carrier is entitled to additional freight to pay for the escort convoy.

In item 14, the state number of the semitrailer or container is indicated in case of their export from abroad after a temporary stay there. For example, if the semitrailer was temporarily left abroad for some reason (for repair in connection with an accident or after diagnostic control), then when it is exported to the country of registration, the license plate number shall be recorded in paragraph 14 of CMR.

*It is executed in three counterparts: for the consignor, carrier, and consignee.

*The document shall be signed by the consignor and the carrier.

EX-1 declaration

Declaration for goods manufactured in EU countries and exported outside the EU. EX-1 allows avoiding local VAT. The document shall be executed by representatives of the carrier or manufacturer (supplier) having a relevant license. The EX-1 declaration shall be presented when crossing the borders of the European Union.

T1 declaration

Declaration for accompanying the non-EU goods to the EU. It shall be executed by authorized representatives of the supplier or carrier at customs warehouses, at the EU border, if the goods are imported by land, and during transportation by air it can be executed directly on board of the aircraft.

TIR (Transports International Routiers) system

The main purpose of the TIR system is to simplify the crossing of state borders for carriers, and to establish transparent rules for the customs authorities of the countries where the system is adopted. TIR works in more than 50 countries, and the customs authorities of these countries have authorized more than 4,000 carriers to work under this system.

System operation rules:

- cargoes are sealed during transportation and any access to them is excluded (due to the use of seals and special containers);

- the cargo is accompanied by a TIR Carnet (International Road Transport).

TIR Carnet is a document accompanying the cargo during transportation between the customs offices of the consignee and the consignor. The document shall be issued by authorized organizations (in Ukraine, it is the Association of Road Carriers) and looks like a book containing 4-14 sheets. The first sheet is fixed, and the inner ones shall be torn off when passing the next customs.

TIR CARNET is an international customs document giving the right to transport the goods across state borders in customs-sealed car bodies or containers under a simplified customs clearance procedure. The document covers road and rail transportation of goods (carried out in vans, trailers, semi-trailers and containers) between the states that have recognized the Customs Convention on the International Transport of Goods under Cover of the International Road Transport Carnets (TIR) 1959 and 1975 (see paragraph 4). All road vehicles must have appropriate permits issued by the competent authorities for their use.

Now increasingly more goods are transported using TIR. This speeds up delivery and reduces transportation costs.

Bill of lading is an invoice in sea transportation.

It is a document accompanying the cargo during sea transportation.

Functions and purpose of the bill of lading:

- it confirms receipt of the cargo by the carrier and description of the cargo condition;

- it serves as a consignment note and a shipping document;

- it confirms the contract for the carriage of goods.

The bill of lading shall be issued by the carrier to the consignor and certify the transfer of the goods for transportation. It is issued in three counterparts: for the consignor, carrier, and consignee. In this case, one of the copies is stamped "Original", and the other two – "Copy". The document stamped "Original" shall be sent to the consignee and allow receiving the cargo.

Data to be entered in the bill of lading:

- vehicle name;

- consignee’s details;

- consignor’s details;

- carrier’s details;

- data on the place of receipt and loading;

- cargo destination;

- time and place of the document issuance.

Airwaybill.

Document for air transportation.

An air waybill cannot be a document of title, but serves to confirm the existence of a contract of carriage and transfer of cargo to the carrier. On the other hand, an air waybill can serve as a customs declaration.

The document is prepared by the consignor (or his agent) under the invoice in three counterparts:

1. For the carrier. It shall be signed by the consignor and kept by the carrier;

2. For the consignee. It shall be signed by the consignor and the carrier and kept by the consignee;

3. For the consignor. It shall be delivered to the consignor of the goods and confirm the delivery and acceptance of the goods by the consignee.

Data entered into the airwaybill:

- departure and arrival points;

- list of documents attached to the consignment note;

- cargo value;

- the cost of freight;

- date of execution.

*The consignor shall be fully responsible for the accuracy of the data in the airwaybill

Types of invoices:

MAWB: It shall be issued by the airline and contain information about the agents or shipper in the country of departure and the country of receipt.

HAWB: It shall be issued by the agent and contain full information about the consignor and consignee based on the invoice attached to the cargo.

*The number of the waybill is always unique, and this number can be used to track the cargo.

|

UKRAINE CHOP (Transcarpathian region) |

HUNGARY ZAHONY (HU724000) |

|

UKRAINE UZHHOROD (Transcarpathian region) |

SLOVAKIA VYSNE NEMECKE (SK532100) |

|

UKRAINE DIAKOVO (Transcarpathian region) PORUBNE (Chernivtsi region)

|

ROMANIA HALMEU (ROCJ4310) SIRET nr 46 / SIRET (ROIS8200) |

|

UKRAINE SHEHYNI (Lviv region) |

POLAND MEDYKA (PL401030) |

|

UKRAINE HREMYACH (Chernihiv region) |

RUSSIA POGAR |

|

UKRAINE NOVI YARYLOVYCHY (Chernihiv region) |

BELARUS NOVA HUTA |

|

UKRAINE MAMALYHA (Chernivtsi region) |

MOLDOVA CRIACENI BRICENI MYRNE |

EN

EN

We provide calculation within 15 minutes

We provide calculation within 15 minutes